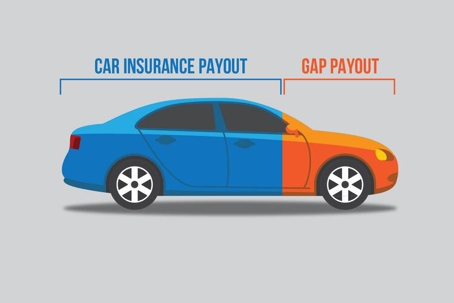

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance is also called "loan/lease gap coverage." This type of coverage is only available if you're the original loan or leaseholder on a new vehicle. Gap insurance helps pay the gap between the depreciated value of your car and what you still owe on the car at the time the car is totaled or stolen.

How Does Gap Insurance Work in Texas?

Gap insurance isn't required in Texas. When you buy or lease a new car, the car depreciates in value quickly over the first few years, meaning the amount of money you owe on the vehicle is often greater than its value. In fact, your new car depreciates and is worth less the moment you drive it off the dealer’s lot. If your car is then totaled in an accident, or stolen, the amount of money you would receive from the insurer would only equal the vehicle's actual cash value at the time of the incident. Gap insurance covers the difference, or “gap,” between what you owe on the car and its actual cash value, so you won't have to make payments for a vehicle you no longer possess. Therefore, gap insurance coverage is a great thing to have if you purchase a new car but is not generally worth it if your car is several years old, or if you bought it used.

Texas Gap Insurance Laws

Gap insurance is not required in the state of Texas, and it can't be required as a condition of receiving an auto loan or lease. If you choose to purchase a gap waiver, Texas law limits the cost of coverage to 5% of the loan amount, assuming you purchased the car, per the retail installment contract. Similarly, if you leased your car, a gap waiver can only cost up to 5% of the adjusted capitalized cost specified in your lease.

What Does Gap Insurance Cover?

Gap insurance is designed to cover the financial shortfall that can occur in specific situations. Here’s what it typically covers:

The Difference Between Loan Balance and Vehicle Value

If your car is totaled or stolen, gap insurance pays the amount left on your car loan or lease that exceeds the car’s current value. It ensures you don’t have to pay out-of-pocket to clear the loan or lease.Total Loss Situations

Gap insurance kicks in only when the vehicle is declared a total loss, either after a serious accident where repairs would cost more than the car’s value or in the event of theft when the car is not recovered.Leased Vehicles

Gap insurance is especially useful for leased cars since lease terms rarely account for how quickly vehicles lose value. Many leases even require gap insurance, ensuring you’re not responsible for paying the remaining lease agreement after a total loss.

What Gap Insurance Does Not Cover

While gap insurance is an excellent safety net for specific situations, it’s important to understand its limitations. Gap insurance will not cover the following:

Deductibles

Gap insurance typically doesn’t cover your auto insurance deductible, though some policies may offer this as an optional add-on.Repairs or Damage to the Car

It won’t pay for repairs, maintenance, or any partial damage to your car. For such issues, you’ll need your standard collision or comprehensive insurance.Down Payments or Loan Penalties

If you didn’t make a down payment on the car or if you have additional loan penalties (e.g., late payment fees), gap insurance won’t cover these amounts.Negative Equity from Trade-Ins

If you rolled over negative equity from a previous loan into your current car loan, gap insurance may not cover this amount. For instance, if you owed $5,000 on your trade-in car and added that to a new car loan, gap insurance usually won’t pay off the negative equity.Use or Wear and Tear

Gap insurance does not provide coverage for mechanical breakdowns, depreciation over time, or wear-and-tear issues.